Plastic industry in Vietnam has grown rapidly in recent years, attracting investment and creating jobs. This growth has led to rapid expansion of the domestic manufacturing sector, making Vietnam an important player and a destination for distributors in the global market.

1. Growth of Plastic Industry in Vietnam

The plastic industry in Vietnam has been one of the fastest-growing sectors in recent years. Compared to other established industries such as machinery, electronics, textiles and chemicals, the plastic industry has shown robust growth momentum as a table below.

From 2024 and 2029, the plastic industry in Vietnam is expected to grow at a compound annual growth rate of 8.44%, trailing only telecommunications and electronics. This rapid growth has made the plastic industry a significant contributor to Vietnam’s economy, accounting for around 6.7% of the country’s GDP in 2019.

| Metric | Plastic | Machinery | Electronics | Textiles | Telecommunications |

| Market Size (2023) | $25 billion | $32 billion | $45 billion | $35 billion | $18 billion |

| CAGR (2024 – 2029) | 8.44% | 3.28% | 10.57% | 5.01% | 11.3% |

| Number of Companies | ~4,000, 90% SMEs | ~2,500, mix of large and SMEs | ~1,800, dominated by large MNCs | ~6,000, mostly SMEs | ~1,500 |

| Export Destinations | US, Japan, South Korea | China, Japan, US | China, US, EU | US, EU, Japan | US, China, EU |

In terms of the number of companies, Vietnam is home to nearly 4,000 plastic companies, with the majority (90%) being small and medium-sized enterprises concentrated in the southern region of the country. This large and growing number of plastic companies highlights the industry’s importance and potential for further expansion.

Import and export of plastic industry in Vietnam

Vietnam’s plastic industry has experienced a persistent trade deficit for many years, increasing from $7.3 billion in 2015 to $14.6 billion in 2020.

Reasons for the trade deficit:

- Domestic plastic material supply can only meet 20% of market demand, the remaining 80% must be imported.

- Imported plastic materials are used to produce inputs for other industries (electronics, auto, construction), but the value of these plastic components is not included in plastic industry exports.

- Main plastic products (packaging, household items, construction pipes) primarily serve the domestic market, with negligible exports.

Table 1: Vietnam’s plastic export and import turnover from 2015 to 2020

| Year | Import

(Billion USD) |

Export

(Billion USD) |

Deficit

(Billion USD) |

| 2015 | 9.9 | 2.6 | 7.3 |

| 2016 | 10.9 | 2.8 | 8.1 |

| 2017 | 13.3 | 3.3 | 10.0 |

| 2018 | 15.3 | 4.2 | 11.1 |

| 2019 | 15.5 | 4.7 | 10.8 |

| 2020 | 19.6 | 5.0 | 14.6 |

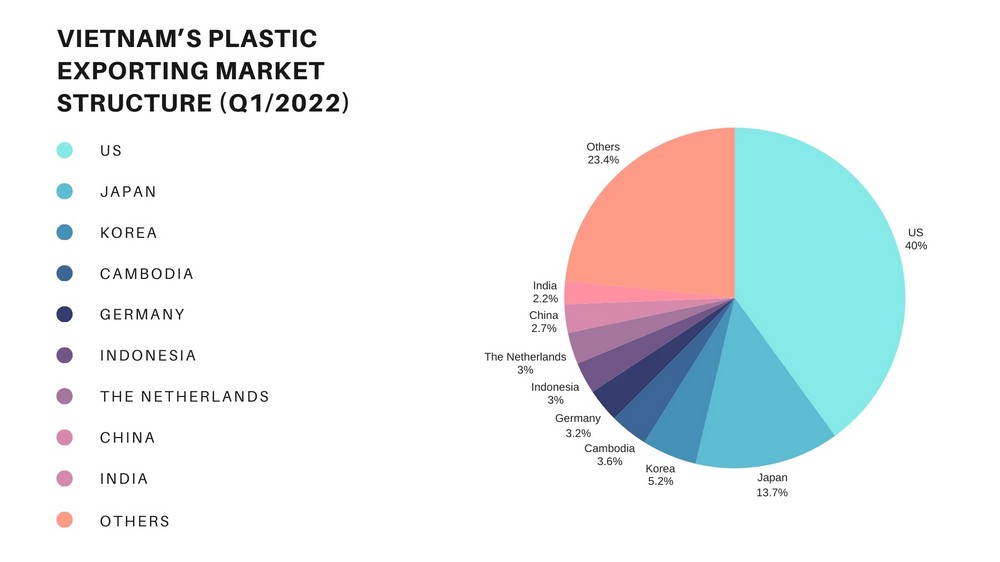

Structure of plastic products and materials

Vietnam has strengths in the production of plastic packaging, consumer goods, construction materials and some advanced plastic products such as oil pipes and auto parts, machinery and computers.

However, in general, our country’s plastic products still lack diversity in design, type and high value, except for some leading companies such as Inochi Global and Viet Nhat Plastics, which are promoting product research to serve the international market.

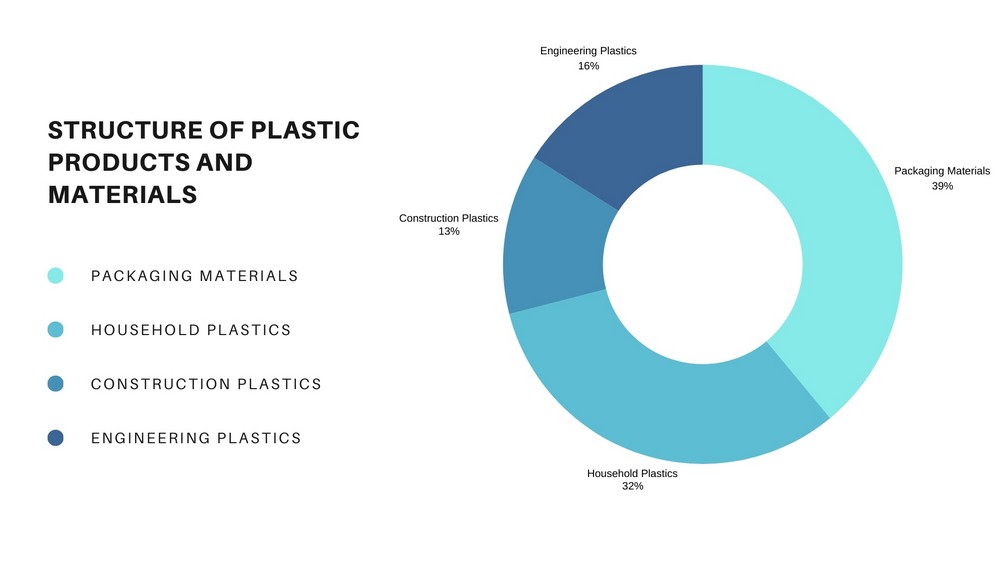

The structure of plastic products can be divided into four main groups: packaging plastics, household plastics, construction plastics and engineering plastics.

| Product Category | Percentage | Production Method | Primary Raw Material | Main Uses |

| Packaging Materials | 39% | Extrusion Blow Molding | PE, PP, PET | Food and beverage processing, retail, and supermarket applications |

| Household Plastics | 32% | Press Molding Technology | PE, PS, ABS | Everyday household items |

| Construction Plastics | 13% | Extrusion and Recycling Tech | PE, PVC | Building materials for construction enterprises and consumers |

| Engineering Plastics | 16% | Injection Molding | PE, PVC, PU | Components for electronics, automobiles, and motorcycles |

This demonstrates the plastic industry’s strong performance and its increasing significance within the Vietnamese economy.

2. Why Plastic Industry in Vietnam Is Expanding So Rapidly Nowadays

There are many driving forces behind the growth of the plastics industry in Vietnam, including international trade agreements and policies to support domestic businesses from the Governments.

2.1. Economic and Policy Factors

Vietnam’s economy has been growing rapidly, with its GDP per capita increasing over the years. Vietnam’s economy has developed rapidly, with annual increases in GDP per capita reaching US$ 4,284 in 2023. In 2023, Vietnam’s economy grew by 5.8% to US$ 435 billion, making it the 35th largest economy globally. This economic growth has driven up the demand for plastic products.

Additionally, the Vietnamese government has implemented favorable policies and trade agreements that have helped the plastic industry expand. For example, the shift of manufacturing from China to Vietnam has benefited the plastic industry in Vietnam.

2.2. Demand Factors

The demand for plastic products has been increasing across various sectors, such as packaging, consumer goods, and electronics. This is because plastic is a versatile material that is widely used in many applications.

There has also been a shift towards more environmentally-friendly and green products, which has created new opportunities for the plastic industry to develop sustainable plastic alternatives.

2.3. Supply Factors

Companies, both domestic and foreign, in Vietnam have been expanding their production capacity to meet the increasing demand for plastic products. These companies have invested in modern machinery and technology to improve production efficiency and product quality. This has helped the plastic industry in Vietnam increase supply and meet the growing demand.

Additionally, it is worth noting that labor costs in Vietnam are very low, even cheaper compared to China. This is also a reason why products in Vietnam can be of very high quality, comparable to major players in the industry like Tupperware or Lock&Lock, while still being very affordable.

3. Key Trends in Vietnam’s Plastic Industry

Consumer demand is changing in a more positive direction in this rapidly growing plastics industry in Vietnam.

3.1. Packaging Plastics

Packaging plastics are experiencing significant growth, particularly in the food, beverage, and consumer goods sectors. This increase is driven by rising consumer demand for convenient and safe packaging solutions. As more people shop online and seek ready-to-eat products, companies are focusing on improving their packaging to attract customers.

On top of that, there’s a big push towards using recyclable and sustainable packaging materials. Many businesses are waking up to the fact that reducing plastic waste is not just good for the planet but also what customers want. This shift helps them stay in line with stricter environmental rules while also attracting eco-conscious shoppers.

3.2. Engineering/Technical Plastics

The demand for engineering and technical plastics is on the rise, particularly from the automotive and electronics industries. These sectors require high-quality materials that can withstand various conditions and provide durability.

Plus, new technologies like 3D printing are becoming more popular. This tech allows companies to create parts quickly and with less waste, making the whole production process smarter and more sustainable. As more businesses jump on this trend, the need for specialized engineering plastics is only going to increase.

3.3. Bioplastics

With increasing environmental concerns, there is a noticeable shift towards bioplastics, which offer greener alternatives to traditional plastics. Consumers are becoming more aware of the impact of plastic waste on the environment, leading them to prefer products made from sustainable materials. This trend is encouraging manufacturers to explore bioplastic options in their product lines.

The Vietnamese government is also playing a crucial role in this transition by providing support and incentives for bioplastic production. By promoting research and development in this area, the government aims to encourage businesses to adopt eco-friendly practices. This support is expected to drive growth in the bioplastics market, helping Vietnam become a leader in sustainable plastic solutions.

4. Challenges and Opportunities

Vietnam in the coming years still faces challenges but opportunities are still open for Vietnamese businesses to be able to expand internationally.

Challenges

- Environmental Regulations and Waste Management: Stricter government rules on plastic waste require companies to reduce and manage waste effectively, which can be costly and complex.

- Reliance on Imported Raw Materials: Many companies depend on foreign suppliers, leading to higher costs and potential supply chain issues.

Opportunities

- Foreign Investment: Vietnam is attracting investments that can introduce new technologies and expertise to the local market.

- Technology Transfer: Collaborations with foreign partners can enhance local workforce skills and improve production processes.

- Increased Competitiveness: By adopting modern practices and cheap labor cost, Vietnamese companies can better meet global demand and focus on sustainable solutions.

| These are also the opportunities that Inochi Global has effectively seized to lead the competition in the Vietnamese market and expand into other international markets.

By committing to producing high-quality plastic houseware products that are well-designed and suitable for modern kitchens, yet very affordable, Inochi Global has quickly won the hearts of even the most demanding suppliers in various countries around the world. If you are looking for a place to import a large quantity of goods for your business, please contact us on WhatsApp: +84 85 555 5901 (Mr. Louis Nguyen – Sales Director). Not every factory is ready to offer you free samples like we do, and that’s why to choose Inochi Global, with various USPs compared to others. |

Plastic industry in Vietnam is poised for continued rapid expansion, with the potential to become a major global production hub. However, it is crucial that Vietnam addresses the environmental impact and sustainability concerns associated with this growth.